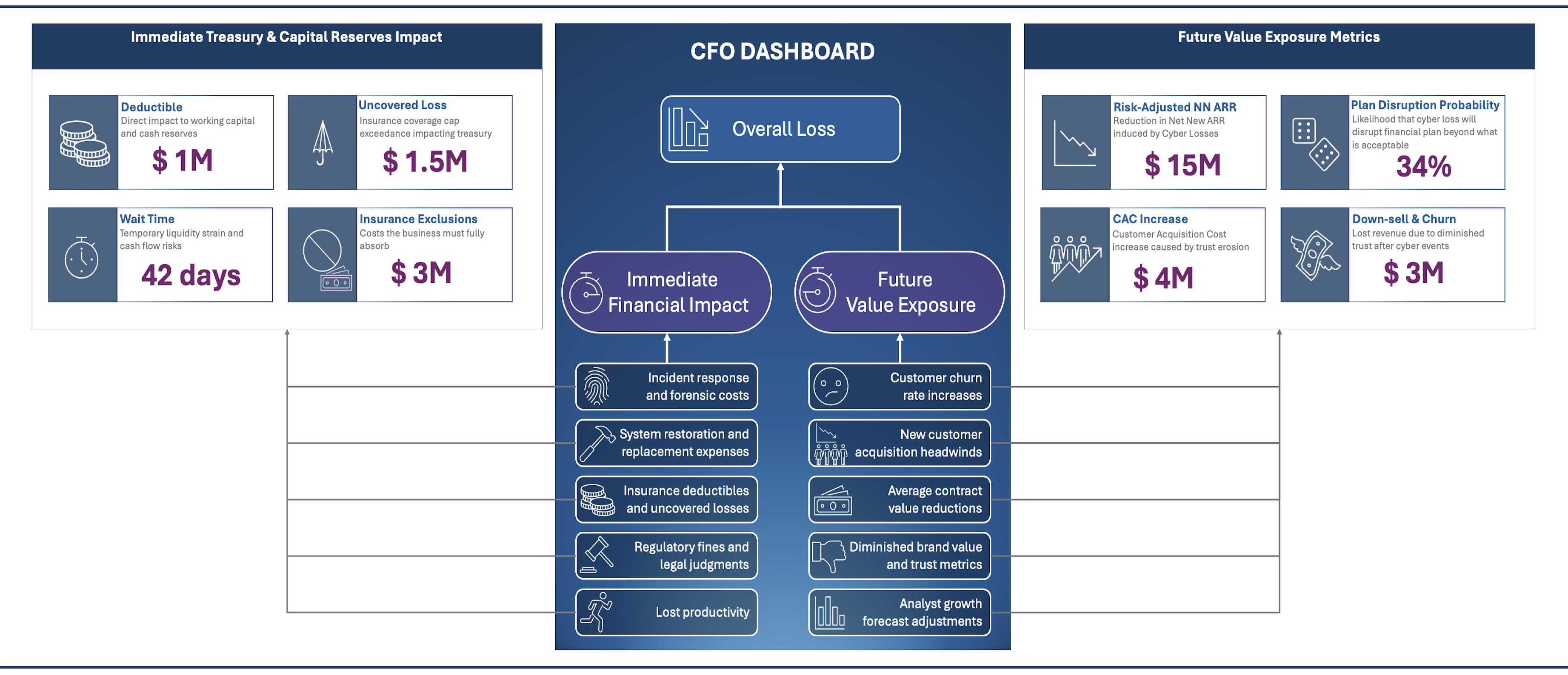

CISOs today must communicate cyber risk in terms CFOs and boards understand: cash flow, revenue disruption, and enterprise value. This article outlines a two-phase model for communicating cyber loss: Immediate Treasury Impact and Future Value Exposure, which aligns with how CFOs think about liquidity, treasury, cash reserves and growth risk. The approach allows CISOS to translate technical incidents into a financial narrative that supports strategic planning and investment.

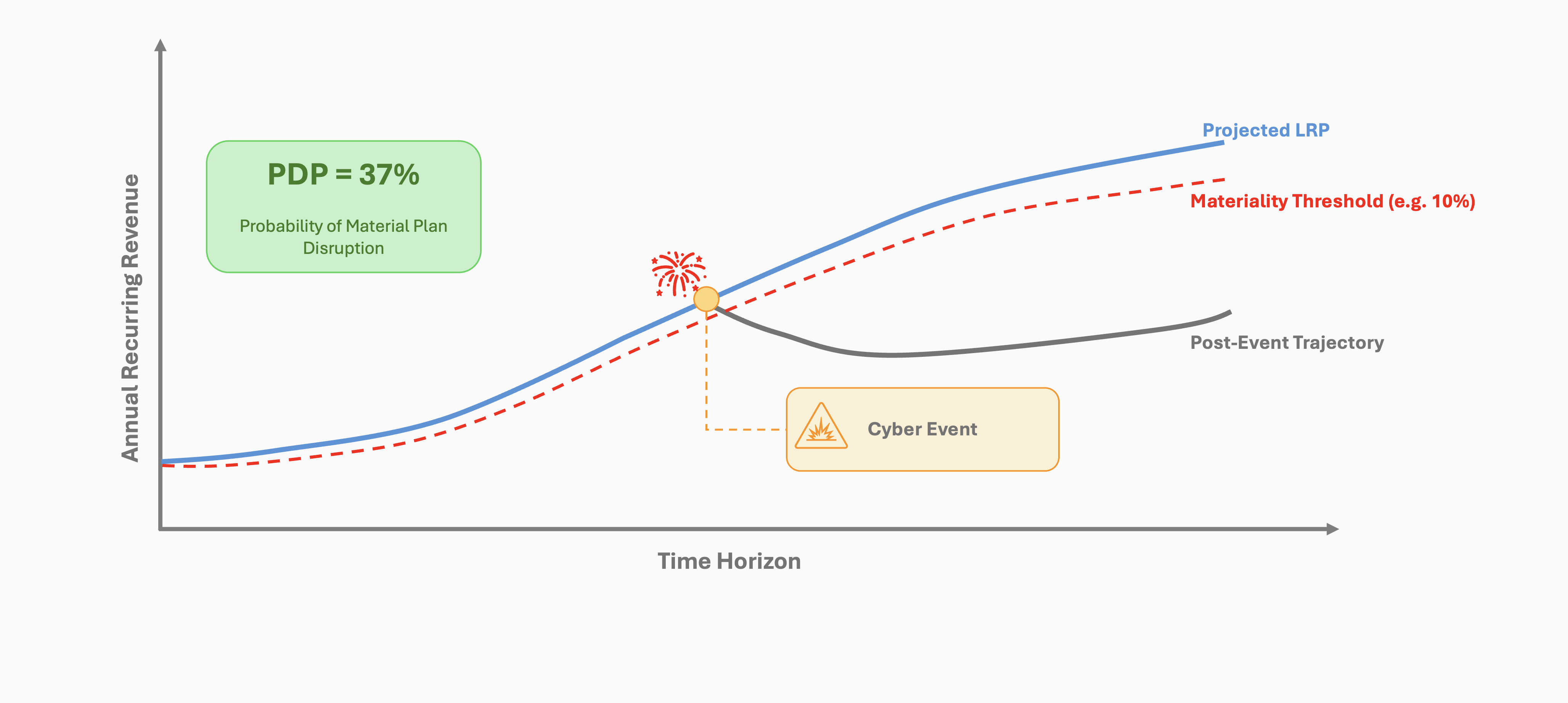

Cybersecurity isn’t just about stopping attacks - it’s about safeguarding the company’s ability to execute its long-range financial plan. Enter Plan Disruption Probability (PDP), a metric that quantifies the likelihood of cyber-induced losses materially derailing financial targets. By measuring PDP, organizations can proactively manage risk within appetite and ensure business resilience.

The modern CISO's role has evolved from mere gatekeeper to growth enabler, necessitating collaboration with peers to elevate cybersecurity's strategic value to executive leadership.

Security is no longer just about defense - it’s about enabling business success. But without the right metrics, leaders struggle to measure impact, justify investments, and drive improvements. This blueprint cuts through the noise, providing a governance framework to track what truly matters across security strategy, operations, and tactics.